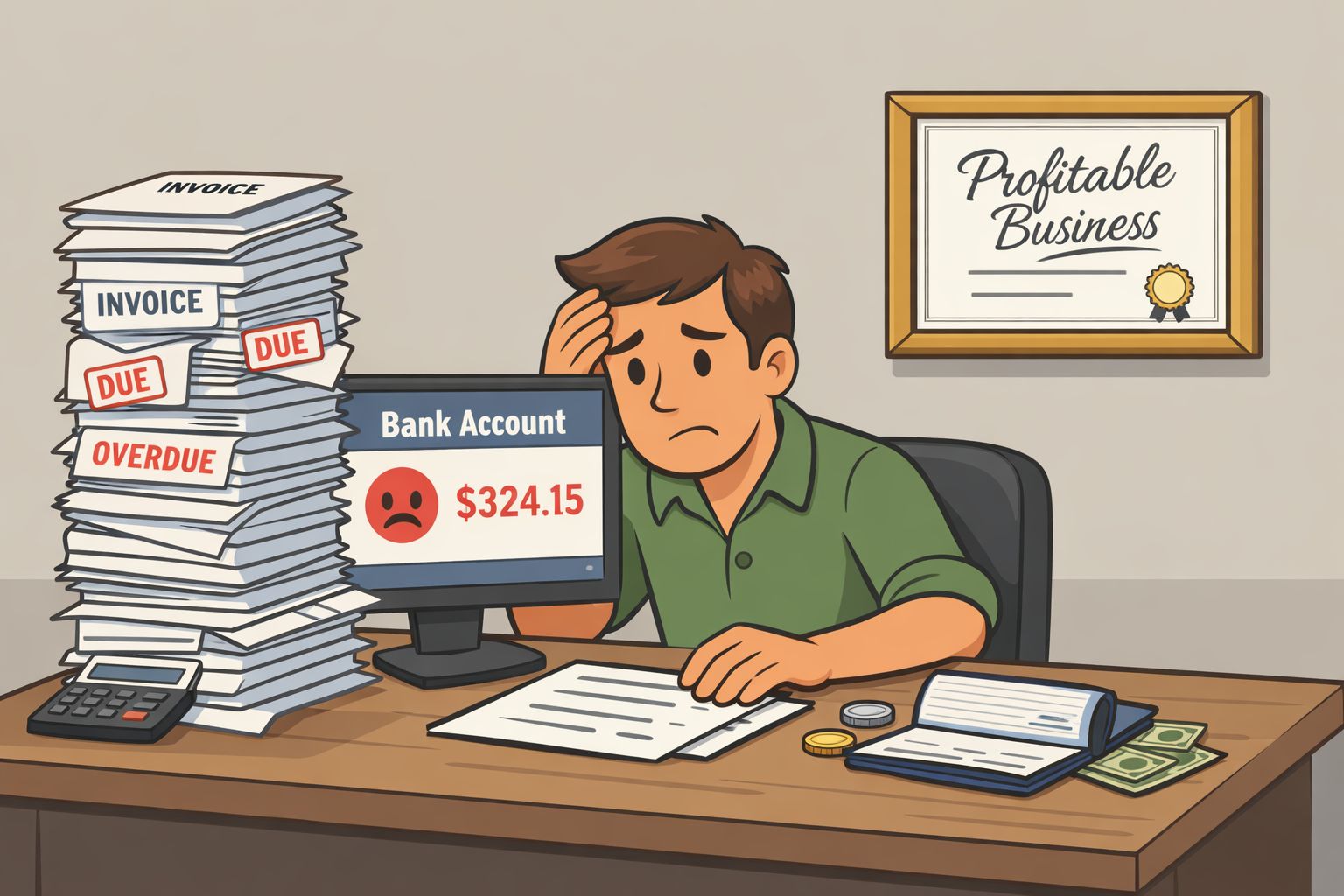

Most new business owners watch profit, but cash flow is what keeps your business alive and moving forward.

You can be “profitable” on paper and still go broke.

Each person who buys from you keeps the cash flow coming.

Track weekly money in vs. money out for bills or supplies.

Keep 2–3 months of expenses in your savings as a buffer to cover unexpected expenses.

Avoid buying big equipment unless it directly helps you make more money now.

New tech gear does not directly relate to profit; only buy equipment when necessary.

Simple rule:

👉 If cash gets tight, cut unnecessary spending. Do not touch the price. Often, overspending solves the issue.

A Simple Cash-Flow Checkup (Weekly habit)

The 1-Minute Cash-Flow Check

Do this every Friday:

Write down the money that came in.

Write down the money that went out.

Ask: Do I have enough for the next 30 days?

If the answer is no. You need to cut spending and or increase marketing to bring in new customers.

Simple rule:

👉 Cash flow is a habit, not a spreadsheet. Take time to look at the numbers; they do not lie.

Easy 4-Word Spending Test

Before you buy any tool, course, or equipment, ask:

“Will this make money?”

If it won’t:

Don’t buy it.

Delay it, until you can afford it.

Or choose a cheaper version. Some vendors lets you make payment plans.

Simple rule:

👉 Every dollar you keep is a dollar that keeps your business alive.

/